“A competitive CT regime based on international best practices will cement the UAE’s position as a leading global hub for business and investment and accelerate the UAE’s development and transformation to achieve its strategic objectives. Introducing a CT regime reaffirms the UAE’s commitment to meeting international standards for tax transparency and preventing harmful tax practices.”

Most companies will be subject to corporate tax starting 1st of January 2024 (those with a calendar financial year). However, if the company has a financial year starting 1st of June and ending 31st May, it’ll be subject to corporate tax starting 1st of June 2023.

All companies and individuals with a commercial license in the UAE will fall under the corporate tax umbrella, with the only exception of companies extracting of natural resources, they’ll remain subject to the current “Emirate level corporate taxation”. Free zone companies are not exempted from the new corporate tax either, but the UAE CT regime has stated that it “will continue to honour the CT incentives currently being offered to free zone businesses that comply with all regulatory requirements and that do not conduct business with mainland UAE”. It is important to note that corporate tax is different from income tax charged on an individual’s personal earnings which UAE does not currently impose.

There are a few income exemptions, however, from the corporate tax being “dividends and capital gains earned by a UAE business from its qualifying shareholdings will be exempt from UAE CT” and “qualifying intra-group transactions and reorganizations will not be subject to UAE CT provided the necessary conditions are met”.

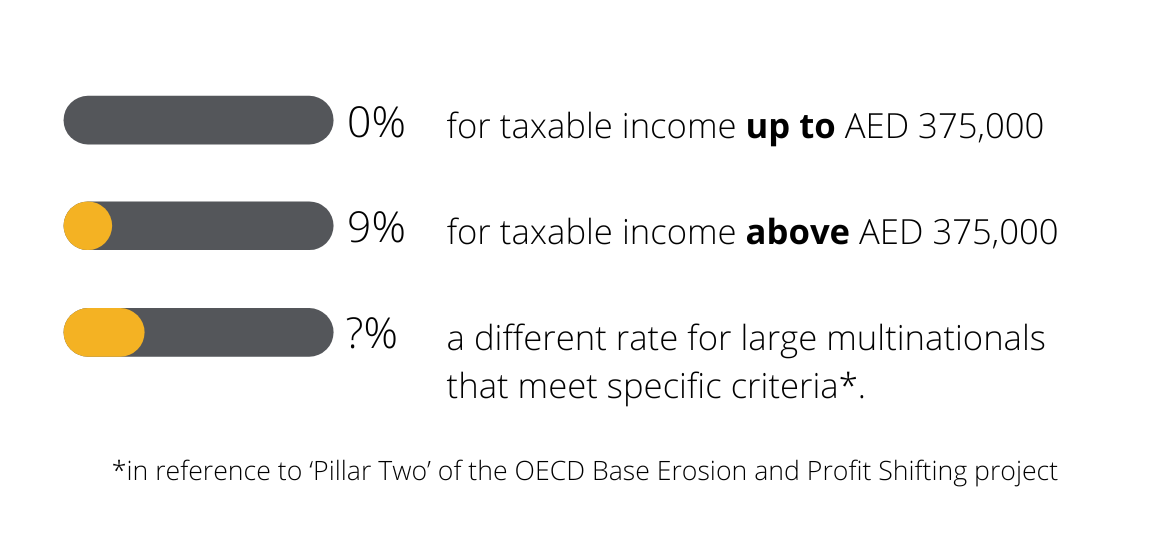

Tax rates will vary and depend on the company’s taxable income:

Calculating Corporate Tax

For those looking to dive into a little more detail, it’s also important to mention that you can use losses incurred to offset taxable income in subsequent financial periods. “A loss for CT purposes (tax loss) would arise when the total deductions the businesses can claim are greater than the total income for the relevant financial period.”

Just like with the UAE VAT, there is a possibility of creating a corporate tax group; a UAE corporate tax group will then only need to file one single tax return. What about withholding tax then you may wonder? That will not be applicable on domestic or cross-border payments.

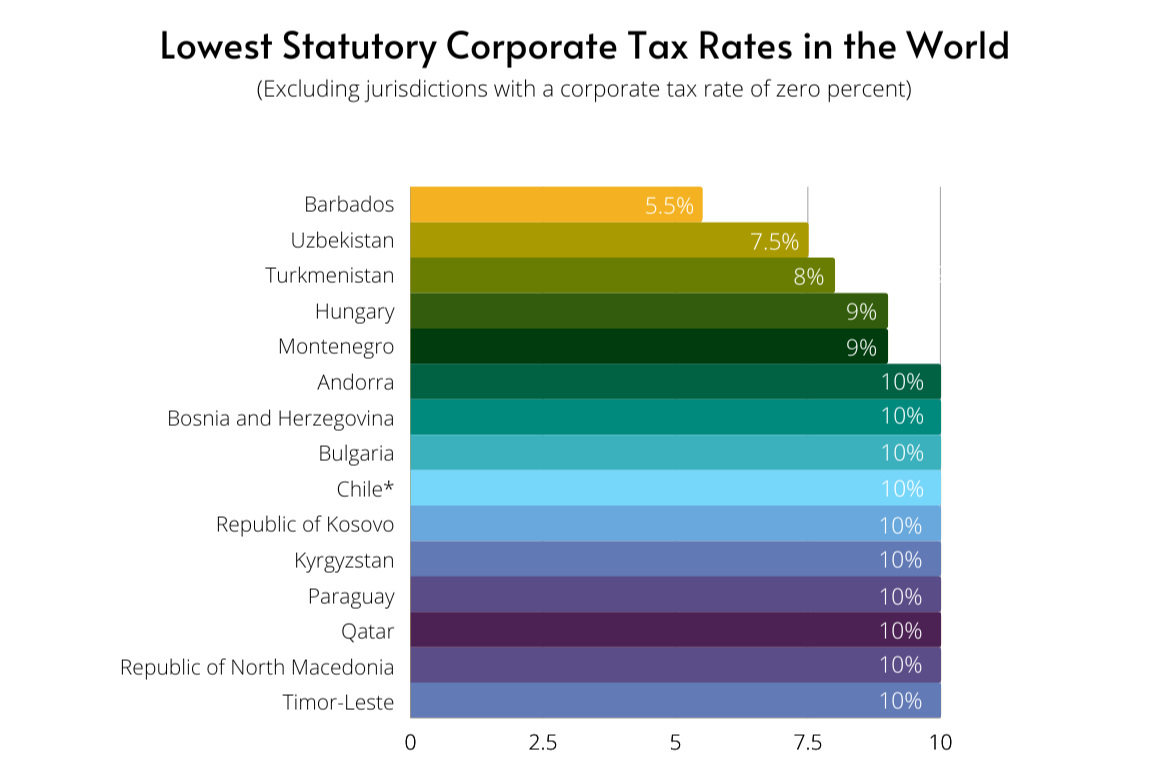

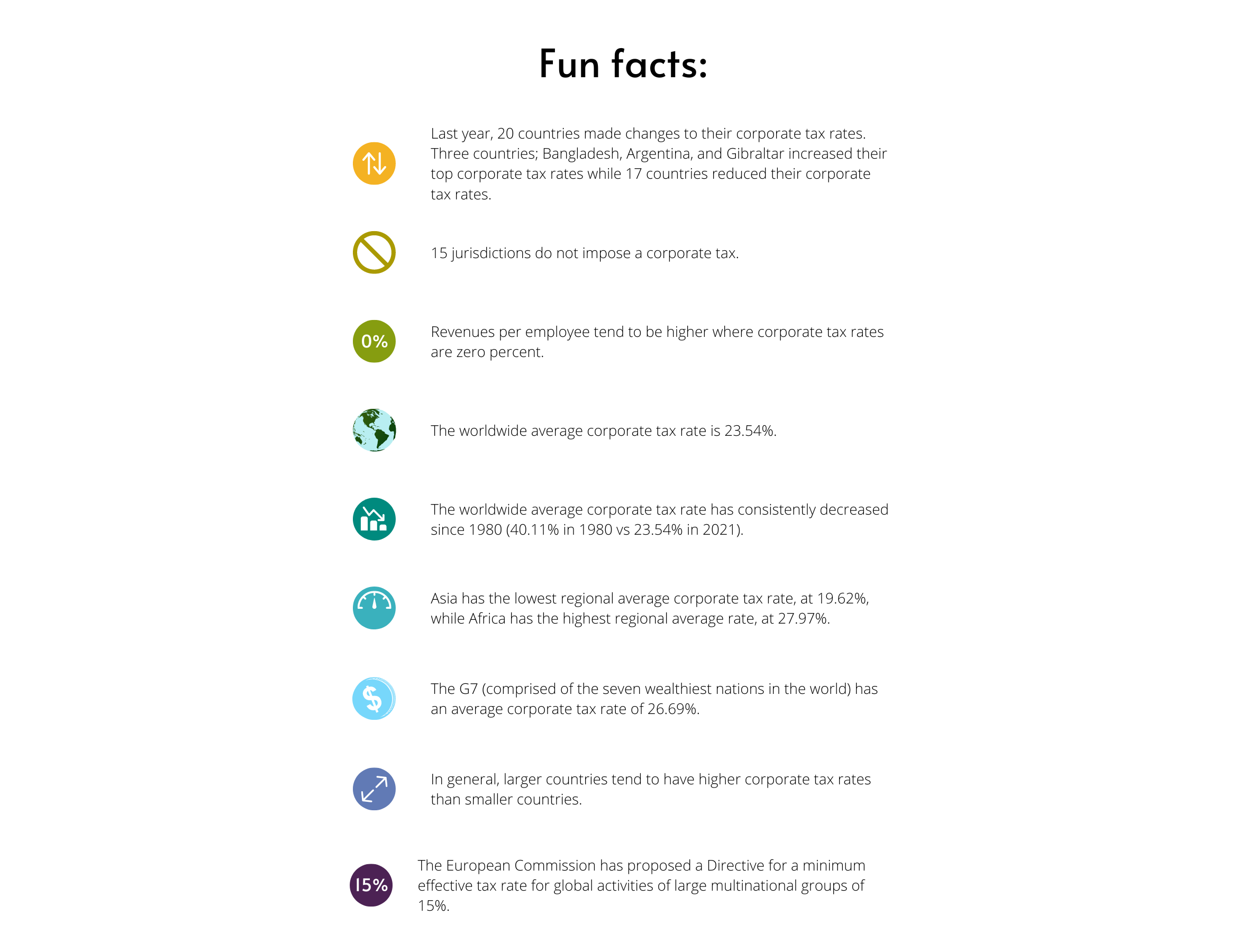

What the future will hold is yet to be seen, some think corporate tax increases are to be expected, the United Kingdom has announced an intention to increase corporate tax, and so has the United States. “Countries around the world have wanted to remain competitive by keeping the tax burden on companies as low as possible in recent years. The cash-strapped governments of 2022 will likely now be considering increasing taxes on corporations”, said Subarna Banerjee, chairman of Urbach Hacker and Young (UHY).

I would like you to look at this blog as a general overview of the subject of corporate tax and urge you to seek professional tax advice before taking any real action towards compliance with the new UAE corporate tax regime.

Sources:

United Arab Emirates Ministry of Finance: Corporate Tax

Gulf News: Corporate tax: What is it and how are business owners in the GCC impacted?

Taxfoundation.org: Corporate Tax Rates Around the World

European Commission: Minimum Corporate Taxation

Tax ‘Haven’ UAE to Impose Corporate Taxes for the First Time

UAE Readies for GCC’s Lowest Tax Regime as Global Corporates Brace for Tariff Hikes

OECD: Corporate Tax Statistics – Country by Country